Bitcoin price on Binance has been a hot topic among cryptocurrency traders and investors. Understanding the factors influencing the price of Bitcoin on this popular exchange can help individuals make informed decisions when buying or selling this digital asset. In order to shed light on this subject, we have compiled a list of 2 articles that provide valuable insights into Bitcoin price movements on Binance.

Bitcoin price on Binance has been a hot topic among cryptocurrency traders and investors. Understanding the factors influencing the price of Bitcoin on this popular exchange can help individuals make informed decisions when buying or selling this digital asset. In order to shed light on this subject, we have compiled a list of 2 articles that provide valuable insights into Bitcoin price movements on Binance.

Analyzing the Impact of Market Sentiment on Bitcoin Price on Binance

Bitcoin has become one of the most talked-about assets in the world of finance, with its price constantly fluctuating based on various factors. One of the key factors that can influence the price of Bitcoin is market sentiment. Market sentiment refers to the overall attitude or feeling of investors towards a particular asset or market.

On Binance, one of the world's largest cryptocurrency exchanges, market sentiment plays a crucial role in determining the price of Bitcoin. When investors are optimistic about the future of Bitcoin, they are more likely to buy, driving up the price. Conversely, when sentiment is negative, investors may sell off their Bitcoin, causing the price to drop.

There have been several instances where market sentiment has had a significant impact on the price of Bitcoin on Binance. For example, in 2017, when Bitcoin reached an all-time high of nearly $20,000, market sentiment was overwhelmingly positive, with investors bullish on the future of the cryptocurrency. This positive sentiment drove the price of Bitcoin to new heights.

However, market sentiment can also have a negative impact on the price of Bitcoin. In 2018, when the cryptocurrency market experienced a major correction, sentiment turned bearish, leading to a sharp decline in the price of Bitcoin.

The Role of Trading Volume in Determining Bitcoin Price on Binance

Bitcoin, the world's most popular cryptocurrency, has been subject to much speculation and analysis in recent years. One key factor that has been closely examined is the role of trading volume in determining its price on Binance, one of the largest cryptocurrency exchanges in the world.

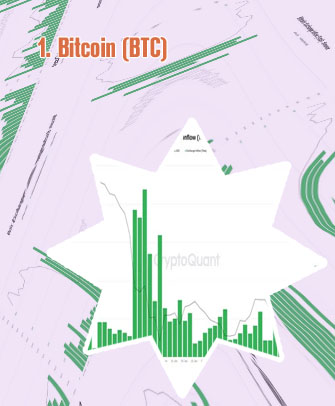

Trading volume refers to the total number of Bitcoins being bought and sold on Binance within a specific time period. It is widely believed that high trading volume indicates strong market activity and can lead to price movements in either direction. This is because an increase in trading volume often reflects increased investor interest and can result in greater price volatility.

Several studies have shown a strong correlation between trading volume and Bitcoin price movements on Binance. High trading volume has been associated with sharp price increases or decreases, while low trading volume tends to lead to more stable prices. This relationship has led many traders and analysts to closely monitor trading volume as a key indicator of potential price movements.

In order to better understand the relationship between trading volume and Bitcoin price on Binance, it is important to consider factors such as market sentiment, regulatory developments, and macroeconomic trends. Additionally, analyzing trading patterns and investor behavior can provide valuable insights into future price movements. By taking these factors into account, traders and investors can make more informed decisions when buying or selling Bitcoin